MARKET OPPORTUNITIES

“The climate adaptation

market could be worth

$2 trillion dollars

by 2026″

Climate Transformation Markets

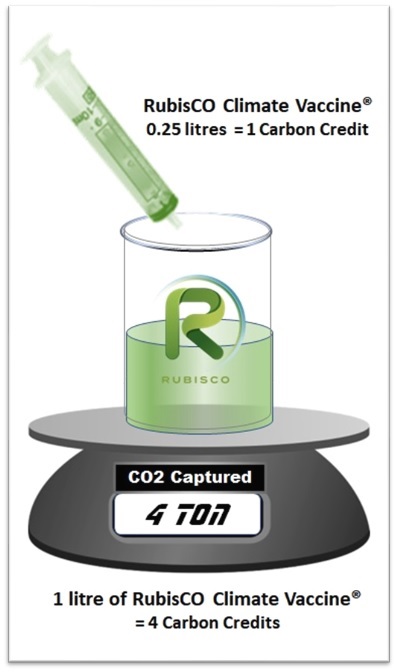

RubisCO Limited is well positioned with its unique solution to take advantage of the growing global climate transformation market.

Partners

RubisCO can provide opportunities for partners in production and deployment

Production

RubisCO Limited has identified specific industry sectors and locations for the siting of its Carbon Dioxide Reduction (CDR) units

Deployment

In order to deliver the solution to the required levels of removal of Carbon Dioxide and sequestration RubisCO Limited seek specific partner(s) capable of working with us to address the challenge and scale required

State Carbon Transformation Market

Governments investing in global climate changing solutions.

RubisCO Limited welcomes the opportunity of working with governments and agencies to enable global rollout of its solution

A Report to UN COP 27 identifies the growth of the climate adaptation market

UN Report COP 27

Why invest in climate adaptation?

“Now is the time for private businesses and investors to place their bets on climate adaptation, especially in developing countries.

The climate adaptation market is huge and growing, the business models are in place, the opportunities are diverse and the surge of public funding for adaptation sweetens the deal.

Investing in climate adaptation now means a chance at handsome financial returns while fighting climate change and helping the world’s most vulnerable..”

- A growing market

The climate adaptation opportunity is enormous — and growing. The market could be worth $2 trillion per year by 2026, and the need for adaptation solutions will grow as climate impacts become more prevalent. - Proven business models

Opportunities in the climate adaptation sector remain relatively unknown. For entrepreneurs and investors alike, this is an advantage. Being an early market entrant may allow private businesses to gain traction without facing intense competition. Investing in climate adaptation companies can be a smart way for investors to balance risk in their portfolios, by serving as a hedge against exposure to climate events. - Public capital availability

Tens of billions of dollars of public capital are already flowing to climate adaptation projects in developing countries. Much of this is in the form of blended finance, which means private investors can leverage public dollars to augment their investments.